The accountancy profession in Malaysia is regulated by the Malaysian Institute of Accountants MIA through the powers conferred by the Accountants Act 1967. Ii having been issued a certificate by the Bar Council under rule 6 in.

Overview Of Accounting Ppt Download

The AGD believes that the adoption of MPSASs together.

. Accounting principles and standards. Public sector accounting is set to be transformed as Malaysia adopts an accrual accounting system under the MPSAS framework explains Ramesh Ruben Louis. It came into full effect starting 2018 along with the global implementation timeline.

It is established under Financial Reporting Act 1997 as an independent authority to develop and issue accounting and financial reporting standards in Malaysia. IFRS or International Financial Reporting Standards are established by the International Accounting Standards. Formed in 1946 the Department of the Accountant General of Malaysia is responsible for the accounting functions of both Federal and State governments in Malaysia and endeavors to comply with the requirement of IPSAS where possible.

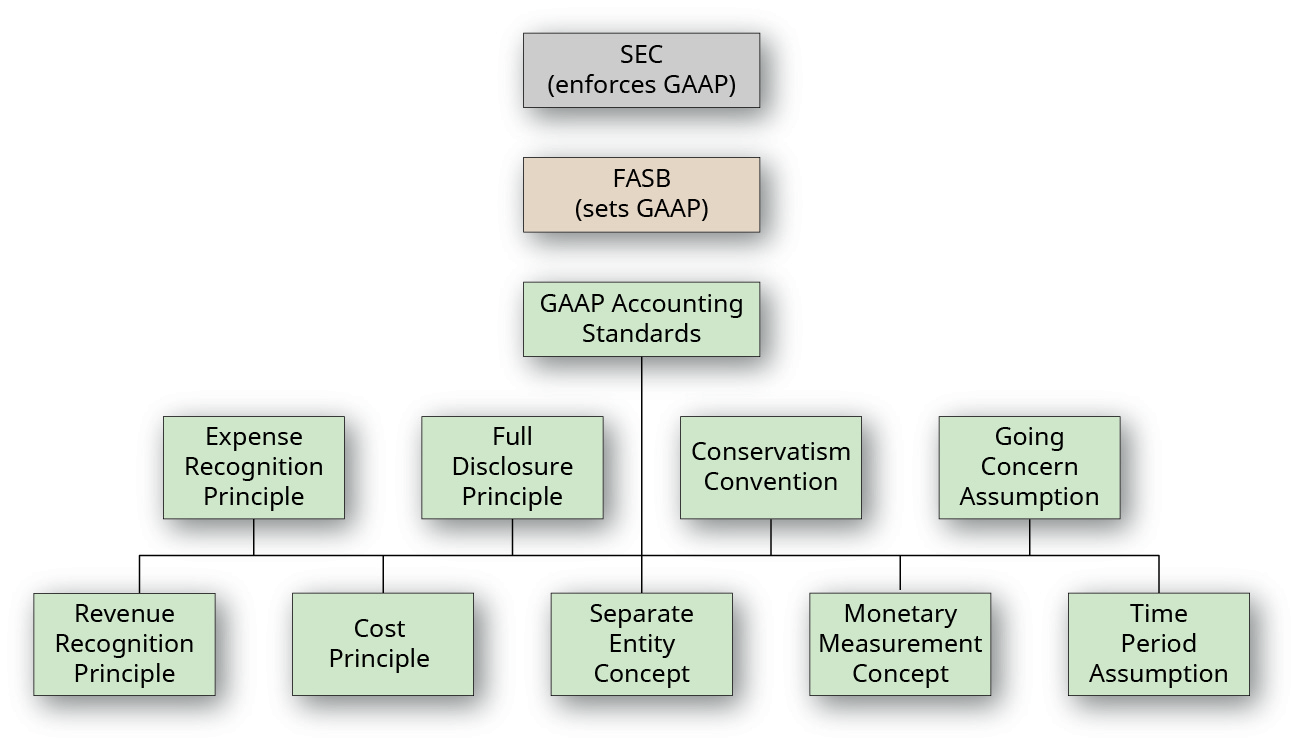

According to accounting historian Stephen Zeff in The CPA Journal GAAP terminology was first used in 1936 by the American Institute of Accountants AIAFederal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934 laws enforced by the US. Prepare your company financial report compliance with Malaysia rules and regulation. Securities and Exchange Commission SEC.

These Audit Risk standards gave rise to conforming amendments to various standards as indicated in the explanatory foreword to the respective standards. MFRS standards are almost on a word-by-word basis in alignment with IFRS and SMEs are permitted to use the MPERS standards. On this page you can access a range of articles books and online resources providing quick links to information such as accounting standards GAAP comparisons and background knowledge.

Financial reporting framework in Malaysia. The Companies Act 2016 CA 2016 repealed the Companies Act 1965 CA 1965 and changed the landscape of company law in Malaysia. Up-to-date information and background knowledge can help support and grow your business internationally.

Malaysian Accounting Standards Board issued the MFRS on 17 November 2014. In Malaysia there are various regulations which govern the issue of general purpose financial. There are three types of approved accounting standards here in Malaysia.

The Chartered Accountant Malaysia or CAM is a designation conferred by the Malaysian Institute of Accountants. Withholding tax rates are 10 15 or 20 of the gross payment. Malaysian Companies Act 2016.

The new accounting standards under the MFRS have been expected to bring more accuracy while calculating financial assets liabilities and other contracts for the buying and selling of. As at 4 February 2016 MIA has 32618 members of which 68 are involved in commerce and industry 22 in. 1 The accounting period specified in an accountants report delivered during the practice year beginning on the 1st day of January shall begin on the 1st of January of that year and terminate on the 31st day of December of the same year.

That Act gives the standards issued by the MASB legal authority. Entities generally are required to prepare their financial statements according to Malaysian Financial Reporting Standards MFRS equivalent to IFRS except for private entities that continue to follow Private Entity Reporting Standards PERS for financial statements with annual periods. Find out about the accounting rules in Malaysia.

In discharging its supervisory functions BNM adopts a risk-based. Effective 1 January 2020 registered foreign. GAAP or Generally Accepted Accounting Principles comprise an established set of standards applicable to a specific jurisdiction.

The MIA is an agency under the Ministry of Finance and reports directly to the Accountant General Office. Every company in Malaysia is required to maintain proper records and accounts to comply with the regulations. IN exercise of the powers conferred by section 7 of the Accountants Act 1967 Act 94 the Malaysian Institute of Accountants with the approval of the Minister makes the following rules.

According to the Fintech Malaysia Report 2021 there are 233 fintech companies in Malaysia. This article will provide an overview of the CA 2016. In Malaysia existing companies are required to comply with the rules and regulations such as Companies Act 1965 Financial Reporting Act 1997 Accounting Standards Income Tax Act 1967 the Securities Commission Guidelines 1995 Kuala Lumpur Stock Exchange KLSE Listing Requirement and Bank Negara Malaysia Guidelines etc during the process.

The Malaysian Financial Reporting Standards MFRS This is the MASB approved accounting standards for entities but this does not include private entities. Interest royalties contract and other service fees lease rentals for movable property and technical fees. The financial reports are important for the accounting process and business references.

In Malaysia the accounting standards are issued by Malaysian Accounting Standards Board MASB. These regulations may be in the form of statutory reporting requirements financial reporting directives and instructions. BNM has broad powers of supervision and control over banking institutions licensed under the FSA and the IFSA.

Bank Negara Malaysia BNM is empowered to act as the regulator of banking institutions under the FSA the IFSA and the Central Bank of Malaysia Act 2009 CBA. Foreign companies listed on a stock exchange in Malaysia may prepare financial statements. The conforming amendments are effective for audits of financial statements for periods beginning on or after 1 January 2006 and have been incorporated in the text of these standards.

International Public Sector Accounting Standards. The CA 2016 reformed almost all aspects of company law in Malaysia. Some of the financial records include invoices serially numbered receipts income records purchase and business expense records.

In the US GAAPs are established and maintained by the Financial Accounting Standards Board FRSB. 1 With a population of 327 million and internet penetration at. It should be noted that foreign companies listed in Malaysia are able to apply either the Malaysian Accounting Standards Board approved accounting standards or acceptable internationally recognized accounting standards.

Companies registered in Malaysia are required to prepare statutory financial statements in accordance with the approved accounting standards issued by the Malaysian Accounting Standards Board MASB. Private Entity Reporting Standards PERS This is the MASB approved accounting standards for all private. Companies are liable to pay withholding tax on the following types of payment made to a non-resident.

Up with a four-pronged implementation strategy for accrual accounting in the public sector in Malaysia that encompass standards and policies rules and regulations process and technology. Authority of the Malaysian Public Sector Accounting Standards 16. Payments and e-wallets make up the majority at 215 and 163 of the fintech players respectively followed by lending 159 and insurtech companies 99.

The Malaysian Accounting Standards Board was established under the Financial Reporting Act 1997 as an independent authority to develop and issue accounting and financial reporting standards in Malaysia. Rules by-laws of.

The Ultimate Guide To Construction Accounting

Ifrs Why Global Accounting Standards

The Ultimate Guide To Construction Accounting

Accounting Standard L Co Chartered Accountants

Describe Principles Assumptions And Concepts Of Accounting And Their Relationship To Financial Statements Principles Of Accounting Volume 1 Financial Accounting

New Restaurant Cash Handling Policy Template Invoice Sample Invoice Template Word Invoice Template

Overview Of Accounting Ppt Download

Gaap Generally Accepted Accounting Principles Llb Cpa

Overview Of Accounting Ppt Download

Accounting Standard Overview History Examples

How To Make A Chart Of Accounts Actionable Tips For Small Business

Furinno 39 5 In Dark Brown Wood 3 Shelf Standard Bookcase With Storage 99736dbr Bookcase Storage Bookcase Storage Shelves

How To Comply With Ifrs Accounting Standards Quaderno